Accounting is the best process of recording and summarizing financial information. That’s why businesses use accounting to manage their financial information organized. Which helps them to analyze their financial data. And also keep them compliant with financial regulation. By the way, accounting consists of two parts bookkeeping and analysis. If you haven’t any prior knowledge about it. Don’t worry we are here to explain what is accounting.

Bookkeeping is known for the process of recording and summarizing financial information. Like transaction recording, sales, purchase, and expense. We will talk about all these things deeper below. So let’s see

Other Recommended Articles:

How to Resolve QuickBooks Error 248?

How to Fix QuickBooks Error 213?

How to Resolve QBWC1039 Error in QuickBooks?

How Accounting Works

Every business either small & mid or large, they have to do accounting. Because accounting tells you the exact cost and profit & loss of the account. So do you ever think of how it works? Accounting can be done by any person who has knowledge or degree of accounts related.

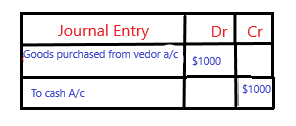

Suppose you are the owner of the business. And you purchase goods for $1000. In purchasing two things happen, first is we have purchased goods. And to purchase these goods we give $1000 to the vendor. So in accounting, there is a rule for Debit the receiver and Credit the giver. So we do entry in journal accounting…

Similarly, we add all the purchases and all the expenses and deduct them from the selling amount. So that we can get the exact revenue of the firm. You will learn more about it when you learn to account.

Purpose Of Accounting

The purpose of accounting is to let business owners know about financial information and the status of the business and cash flow. Through this information, business owners can easily decide to grow their business. And are used to store this information in the form of journal entries, trial balances, balance sheets, and cash flow statements under accounting. And these accounting statements are followed by the generally accepted accounting principles (GAAP) and IFRS. Most of European investors follow IFRS-based accounting statements. While US investors support accounting based on GAAP rules

Types Of Accounting

There are mainly three types of accounting. That will help you to deeply understand, what is accounting. So let’s see below for more info.

Financial Accounting

Financial accounting is a term of defining the process of generating quarterly and annual financial statements. After that, all the financial transactions of a particular business period are summarized inside the balance sheet. In any business financial statement of the firm is audited by the external CPA organization. Let’s look at the various types of accounting…

Managerial Accounting

Managerial accounting is accounting or calculation that provide to the business managers. To take relevant and better decisions to manage businesses. And allocate budgets for the different departments is called managerial accounting. Suppose a firm wants to purchase raw material. Then we have to make a decision that purchasing raw material is profitable or manufacture it in the firm beneficial.

So we have to take the decision on the basis of, manufacturing raw material is cheap or purchasing it from suppliers. Si It’s a decision-making accounting that comes under managerial accounting. That is how much we have to purchase, production, customer range, and market area. These decisions are taken under managerial accounts.

Managerial accounts consist of both types of accounting like monitoring and non-monitoring. Monitoring means money-related or non-monitoring means without money-related. Like how much production occurred during the business period is comes under the non-monitoring decisions. Managerial accounting is performed for the getting internal efficiency profit of the firm.

Cost Accounting

Cost accounting means expenses. Like you bought a pencil at $5. It means the cost of the pencil is $5. Cost accounting is the process of recording all the transactions related to cost. Then we classifying and analyzing that in which area there is too much cost occurs. And in which area we get less cost of the product.

So we can control the cost of the product. Hence we can maximize the profit of the firm. In this accounting, we analyze how much raw material is wasting. We also consider why the cost of the product is increasing. As the cost of the product was $10 before. But now it’s $15. So in cost accounting accountant has to analyze why the cost of the product is increasing. The cause behind cost increases in the product can be anything. like raw material cost has been increased, or labor charges have increased.

Conclusion

So today you learn about what is accounting. And types of accounting. Our advice is to grow the business you need to hire a professional accountant. If you want to manage your business accounting. Or you should learn how to do the accounting so that you can analyze and summarize your business expenses or cost of accounting. If you want to learn more about accounting then comment below for more blog on accounting.