Here, we will discuss how to void or refund customer payments in QuickBooks Desktop in this article. If you want a solution to this query, then here we are providing its solution you can read our complete and follow the steps given in it. Here we have given the best and accurate steps in which you can easily complete this process.

When Can You Void or Refund a Customer’s Payment?

Usually, in this process, if your transaction is not fixed then you can end this payment. If you try to cancel a payment already made, the QuickBooks keep an eye on you and the QuickBooks will let you know That you can return it or give credit instead.

If you can stop the payment then it would be better for you to stop the payment. You charge more in fees with a refund, and then it can take many days for your customer to get the money back.

Void a Customer Payments in QuickBooks Desktop

- First, you need to go and sign into QuickBooks Desktop.

- Click on the option of Customer Center, from the Customers menu.

- In the next window, you can click on the option of the Transactions tab.

- Then, either select the option of Sales Receipts or Received Payments.

- After that, based on the option you can find and open the receipt of payment.

- Then, from the Edit menu and you can click on the option of Void Sales Receipt.

- Finally, you can click on the given option of Save & Close.

QuickBooks void with all your transactions and Handel your business accounting for you.

QuickBooks void transactions instantly and do not charge any other fees from the credit or debit cards but there are some possibilities to your customer’s bank will have authority over the funds. If this happens, the customer may need to contact their bank to remove the hold.

Refund Customer’s Payment or Give a Customer’s Credit Back in QuickBooks Desktop

Using the QuickBooks features you can pay, check, or also return cash from a credit card or back the check to the customer’s credit card account. If you return a credit card, QuickBooks takes care of the important payment processing if you can refund the full amount, partial amount, or for specific products and services.

Some important things which need to do before refunding credit card payments

Here we can provide some requirements that you can do before the Credit card refunds:-

- First of all, you will use the same merchant account/company’s Authentic ID for the original transaction which is already there.

- Within 6 months you can Issue the refund for the original transaction

- Refund the credit card you used to original transact with

- Also, you make sure that you do not refund the amount that more than the total amount processed on the credit card.

When you Have to Done or Met With the Above Criteria Then You are Ready to Refund a Payment

Here we will tell you the process when you have completed the above criteria or you are ready to return for payment,

then you can follow these given steps:-

- First, you need to go to the QuickBooks Desktop and then Sign in to QuickBooks Payments.

- Click on the option of Customers menu in the QuickBooks Desktop, and then select Credit Memos/Refunds.

- Click on the Job dropdown in the Customer, and then click on the option customer you need to refund.

- After that, you can choose the products and services that you want to refund.

- Click on the option of Save & Close when you are done with this process.

- This will opens the window of Available Credit.

- Then, you can click on the option of Give a refund and then press the OK option.

- And whatever you want to give credit for future payments, then you can choose the Retain as available credit option and then select the option of OK.

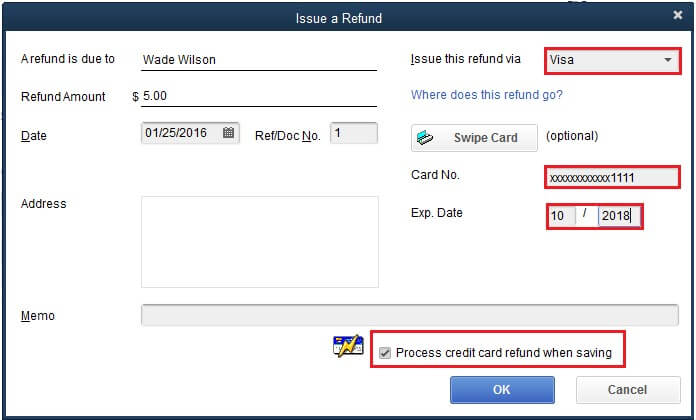

- Then you can choose the option of how you want to refund the transaction from the Issue this refund via a field in the Issue of a Refund window. Then click on the option of the account, that you are paying for the refund from if you choose the Cash or Check payment option.

Other Recommended Articles:

Microsoft Outlook e-mail Integration with QuickBooks (quickbooks outlook integration)

A Way to Run Payroll Summary Report in QuickBooks Online

How to Change your Direct Deposit Bank Account in QuickBooks

When you are using Credit Card Refunding

Here, below we will provide you the details of when you are using a credit card refund then how will you do this. So, check carefully the given steps, and follow if you want to do this:-

- Click the option of in the issue of this refund via field, and then choose the option of the type of credit card (Visa, American Express, and other types) that you need to refund.

- After that, you can enter the credit card info manually, or click on the option of swipe card button and choose either Swipe the credit card and swipe the customer’s card.

- Then, at the right corner of the screen, you can click on the option of the Process credit card refund checkbox when you are saving.

- When all the required steps are done, then click on the OK button.

After that, you don’t need to do anything, the QuickBooks will handle your recording, your refund, and your all accounting.

When will the Customer Get their Money Back?

When the daily QuickBooks in settles your latest transaction at 3 pm at that point, QuickBooks then applies the refund to its customer’s crate card or debit card. However, when credit is seen to your customer it may be some time, and it totally depends on their related bank. It also takes the industry standard is 7 to 10 business days.

Void a Refund or Credit Memo

You can void this process when you have any problem in refund or credit given to a customer and your transaction is not organized.

- From the Customers menu and then click on the option of the Customer Center.

- Then you can find and then open the customer’s profile.

- After that, you can find and then open the option of either Credit Card Refund or Credit Memo that you need to refund.

- Then click on the option of View Refund receipt in the Credit Card Refund or Credit memo window.

- In the last step select the Void Refund and then OK.

Conclusion

Hope that now you can understand how to void or refund customer payment in QuickBooks Desktop. And if you still have any problems, then feel free to call our toll-free number +1-844-405-0904, the Accountwizy ProAdvisor ready to help you for more information.