We all know that negative inventory is a common fact for every business type (small and mid-sized). But it should not be ignored. Today, here we have the article regarding negative inventory in QuickBooks Desktop. This article will be very informative for all QuickBooks Desktop users, so every user must read this article. If you are interested to read this topic then, stay connected with us till the end of the article, and start reading.

QuickBooks Desktop Negative Inventory Overview

Read the below section and get the overview details of QuickBooks Desktop negative inventory.

To View negative Inventory in QuickBooks Desktop

To View the Inventory Valuation Detail (IVD) Report

IVD report is used to evaluate the extent of your negative inventory, and this is the only report by which you can extent negative inventory.

- Navigate towards the ‘Reports’ menu.

- After that, click the ‘Inventory’ option to choose the ‘Inventory valuation’.

To View Negative Item Listing report

The user of QuickBooks Enterprise 15.0, and the later version can use the negative item listing reports. It can only show the current negative quantities, not the past negative quantities.

- Go for the ‘Reports’ menu.

- Select the ‘Negative Item Listing’ option from the ‘Inventory’ tab.

And if you are a user of QuickBooks Premier without advanced inventory

- From the ‘Vendor’ menu, select the ‘Inventory Activities’ option.

- After that, click the ‘Inventory Center’ option

- From the top left of the inventory center window, and change filter from the Active inventory to Assembly to QOH<=Zero.

Other Recommended Articles:

QuickBooks Cannot Communicate With Company File Due to Firewall (Solution to Fix It)

How to Print Paychecks in QuickBooks Desktop

What Will Be the Next Step If An Opening Balance Is Not Entered In QuickBooks Online

Negative Inventory Issues in QuickBooks Desktop

Negative inventory issues in QuickBooks Desktop can occur in different ways due to different reasons. Here we provided all the possible issues of negative inventory in QuickBooks Desktop. Have a look;

Problem 1: Inventory Item has No Average Cost

- You have created a new inventory item, without an initial QOH/VOH, and with an item cost.

- The first transaction to use the item was an invoice instead of a check, bill, credit card charge, adjust quality/value on hand (IAD).

- The inventory item leaves without an average cost.

- The item goes to the negative inventory because of the sale force.

- You may purchase the item for a different cost than the item cost.

Problem 2: Negative Inventory Causes Because of Vendor Reports

Generally, the inventory or the COGS (cost of goods sold) transactions are on the invoice. And selling of out-of-stock inventory causes the next bill to contain an adjusting inventory transaction. All of these adjustments are associated with the vendor and appear on vendor reports.

Problem 3: Inventory Assemblies Show Incorrect COGS on Job Costing Reports

In some cases, some businessmen sell assembly items, when they have an insufficient quantity on hand. But after that, you build assembly items with a cost different from the average cost, whenever you build an assembly item, this will be included with an adjusting inventory, COGS transactions. And the build transaction does not allow you to enter the customer job, name, class, that’s why the class reports, and job costing cannot include the adjusting transactions.

It is very important to prevent inventory quantities from falling into a negative status. So you need to avoid selling assembly items when you have insufficient quantity on hand. If in case, a sale is made, and the QuickBooks records have not yet been updated, so make sure that you enter the build transaction before the sales transactions for the correct reporting.

Solutions to Fix Negative Inventory Issues in QuickBooks Desktop

In the above, you get the idea that which types of issues you may encounter. Now get the solutions for the issues. Here are some solutions for different situations, you need to choose the appropriate solution according to your need.

Scenario 1: If your First transaction is Sale

This procedure will be applicable for you if your inventory reports are incorrect because of the improper establish of average cost. You can display the correct values by ensuring the earliest transaction date for an item is a check, bill, credit card charge or to adjust the quality, and value on hand.

- Go to the ‘Reports’ menu of QuickBooks.

- Then select the ‘Inventory valuation Summary’ option from the ‘Inventory’ section.

- Use the QuickZoom to open the inventory valuation detail report for the item.

- Now you have to QuickZoom the first listed bill to open the enter bills window.

- Then change the date on the bill to a date earlier than the first listed invoice listed on the detail report that you opened in the second step.

- After that, record the bill with the new date by clicking the ‘Save & Close’ option.

- Repeat the second, and above steps for each incorrect item to complete the procedure.

Scenario 2: If you have Sold Inventory Items Without Recording Purchases

If you have entered bills with accounts but not inventory items then, edit the bills change the entries from the expenses tab to the item. But must be alert, this may alter your inventory expenses. If you are decided to go through this process then before that QuickBooks ProAdvisor for the right suggestion.

Scenario 3: If you Entered Purchases/ Adjustments Before Entering Sales

Adjust the transaction dates, if you have entered purchases or adjustments before entering sales. This solution is not risky, and it is genuine, so you can follow this procedure without having any hesitation.

- From the menu bar, go for the ‘Reports; tab, and then for the ‘Inventory’ option.

- Select the ‘Inventory Valuation Detail’ option from the ‘Inventory’ sub-tab.

- Click on the ‘Dates’, and then select the ‘All’ option.

- After that, find the item, which is showing a negative amount in the On Hand column.

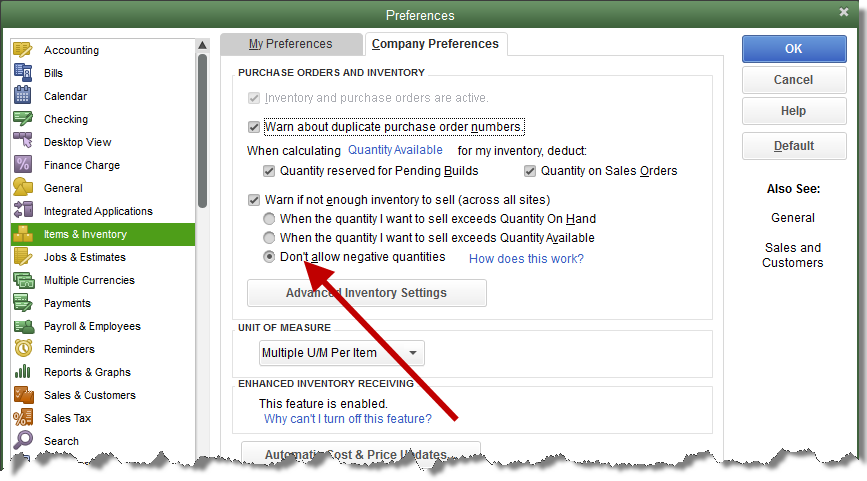

To Prevent Negative Inventory Issues

The above procedures are to fix the negative inventory issues in QuickBooks Enterprise, but here we have given the solutions to prevent the negative inventory issues. So that, a user who has not faced the problem yet, he/she can take all these steps to prevent the issue in the future.

Solution 1: Set Up Inventory Items with Opening Balance

The first solution is to set up inventory items with an opening balance, so follow the below procedure to set up inventory items with an opening balance.

- At first, you need to create a new inventory item.

- After that, enter the necessary information.

- Enter QOH, and the value to establish an average cost, at the bottom.

- You can enter a purchase before entering a sale, if you do not have any units on hand.

Solution 2: Use Sales orders Which you Have Inventory

You can also use the sales orders or estimate to enter sales for which you do have inventory to prevent the negative inventory issue.

- Go for the customer order, and enter it as a sales order.

- Or you can enter the customer order as an invoice and can mark the invoice as pending (Edit> mark Invoice as pending).

- After that purchase the inventory items, and enter the purchase into your company data file.

- And then convert the sales order to an invoice.

- Other you can mark the invoice as final by clicking on the option ‘Mark Invoice as Final’ from the ‘Edit’ section.

Solution 3: Use Pending Invoices Which You Have Inventory

The third solution to prevent negative inventory in QuickBooks is to use pending invoices for which you have inventory.

- Enter your customer order as an invoice.

- After that go to the menu bar, and select the ‘Edit’ option to choose the ‘Mark Invoice as Pending’ option.

- Now purchase the inventory item, and enter the purchase into your company data file.

- Again go to the ‘menu’ bar, and select the ‘Mark Invoice As Final’ option by clicking the ‘Edit’ option.

- At the last, adjust the invoice date with the date on which the goods are shipped to the customer.

Final Words

We hope, you like the article, and now you have the idea to fix negative inventory issues in QuickBooks Desktop, and also have the idea to prevent the issue in the future. You can get our QuickBooks support, if in case, you have any problem regarding the mentioned procedures, or if you want to know more knowledge regarding the negative inventory in QuickBooks Desktop.