Are you worried about the uncollectible payment in QuickBooks? Want to write off the payment as bad debt? Don’t worry, we will guide you to write off bad debt in QuickBooks Desktop, and Online through this article. And will also discuss a little overview of QuickBooks bad debt. Read the article till the end, and keep a clear vision of your business record.

What is Bad Debt in QuickBooks

Whenever an invoice is sent by you, but the money you can’t collect from the customer, and you know that you will never get paid from the customer. Then the amount of money will be categorized as bad debt.

Writing off the bad debt process, ensure you that the net income and the accounts receivable are up to date. This helps you to track the transactions and manage the discrepancies during the taxation.

In QuickBooks, it plays an important role to manage finance and reducing the chances of discrepancy issues while reconciling in QuickBooks with bank statements.

Other Recommended Articles:

How to Fix View My Paycheck Not Working Issue

How to Find QuickBooks Validation Code in Registry

QuickBooks Cannot Communicate With Company File Due to Firewall (Solution to Fix It)

Write Off Bad Debt In QuickBooks Online

If you are a QuickBooks Online user then, follow the procedure to know, how to write off bad debt in QuickBooks Online;

Step 1: Check the Aging Accounts Receivable

In the first step, check the aging accounts receivable. And make sure that, the invoices and receivables are considered as bad debt. Follow the steps to review it;

- Login to the QuickBooks Online, and visit to the ‘Reports‘ menu.

- Select the ‘Accounts Receivable Aging Detail‘ report from the ‘Reports‘ menu.

- And cross-check, which outstanding accounts receivables should be written off in the QuickBooks Online.

Step 2: Create a Bad Debts Expenses Account

In the next step, create bad debts expenses account. And if you already have a bad debt account then you need not create one.

- Visit for the ‘Settings‘ tab, and select the ‘Chart of Accounts‘ option.

- Go to the Top-right corner of the QuickBooks Online dashboard.

- And click on the ‘New‘ option to create a new account.

- Select the ‘Expenses‘ option from the ‘Account Type‘.

- And choose the ‘Bad Debts‘ option from the ‘Detail Type‘ drop-down.

- Enter the ‘Bad Debts‘, in the ‘Name‘ field.

- At the end, select the ‘Save and Close‘ option.

Step 3: Create a Bad Debt Item

If, you have not created an item, for the bad debt then create a non-inventory item. And don’t worry, it is just only to balance the accounting.

- Go to the ‘Settings‘ tab, and select the ‘Products and Services‘ option from the list.

- From the top-right corner, select the ‘New‘ option, and then click the ‘Non-inventory‘ option.

- Type, ‘Bad Debts‘ in the ‘Name‘ field.

- And select the ”Bad Debts‘ option from the ‘Income Account‘ drop-down.

- After setting up all the things, click on the ‘Save and Close‘ option.

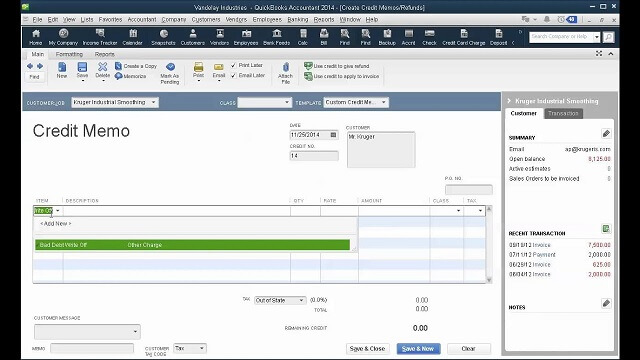

Step 4: Create a Credit Memo for the Bad Debt

Now, it’s time to create a credit memo for the bad debt in QuickBooks Online.

- Click on the ‘+New‘ option, and select the ‘Credit Memo‘ or ‘Give Credit‘ option.

- Choose the customer name from the ‘Customer‘ drop-down.

- From the ‘Product/Service‘ section, select the ‘Bad Debts‘ option.

- Enter the amount that you want to write off, in the ‘Amount‘ column.

- After that, enter ‘Bad debts‘, in the ‘Message Displayed on Statement‘ box.

- At last, click on the ‘Save and Close‘ option.

Step 5: Apply the Credit Memo to the Invoice

In this step, you need to apply the created credit memo to the invoice. Follow the procedure to apply the credit memo;

- Again visit the ‘+New‘ tab, and choose the ‘Customers‘ tab.

- Click the ‘Receive Payment‘ or the ‘Receive Invoice Payment‘ option from the ‘Customer‘ section.

- Select the customer’s name from the ‘Customers‘ drop-down, .

- And the invoice, from the ‘Outstanding Transactions‘.

- Select the credit memo, from the ‘Credits‘ section.

- And save everthing, that you have changed.

Go to the ‘Profit and loss‘ report under the bad debt expense account to see the uncollectible receivable.

Step 6: Run a Bad Debts Report

This step is optional. If you want to, check all receivables that are tagged as bad debts then follow the below procedure;

- From the ‘Settings‘ tab, select the ‘Chart of Accounts‘ option.

- And then in the ‘Action’ column of the bad debts account‘, choose the ‘Run Report‘ option.

Write Off Bad Debt In QuickBooks Desktop

If you are a QuickBooks Desktop user and want to know the process to write off bad debt in QuickBooks Desktop then follow the given procedure;

Step 1: Add Expenses Account to Track the Bad Debt

In the first step, you need to add an expenses account through the chart of accounts. After completing this step, you can track the bad debt easily.

- First, visit the ‘Lists‘ menu, and select the ‘Chart of Accounts‘ from the list.

- And then, choose the ‘New‘ option from the ‘Account‘ menu.

- After that, go to the ‘Expense‘, and click the ‘Continue‘ option.

- Enter the ‘Account Name‘, and click the ‘Save and Close‘ option.

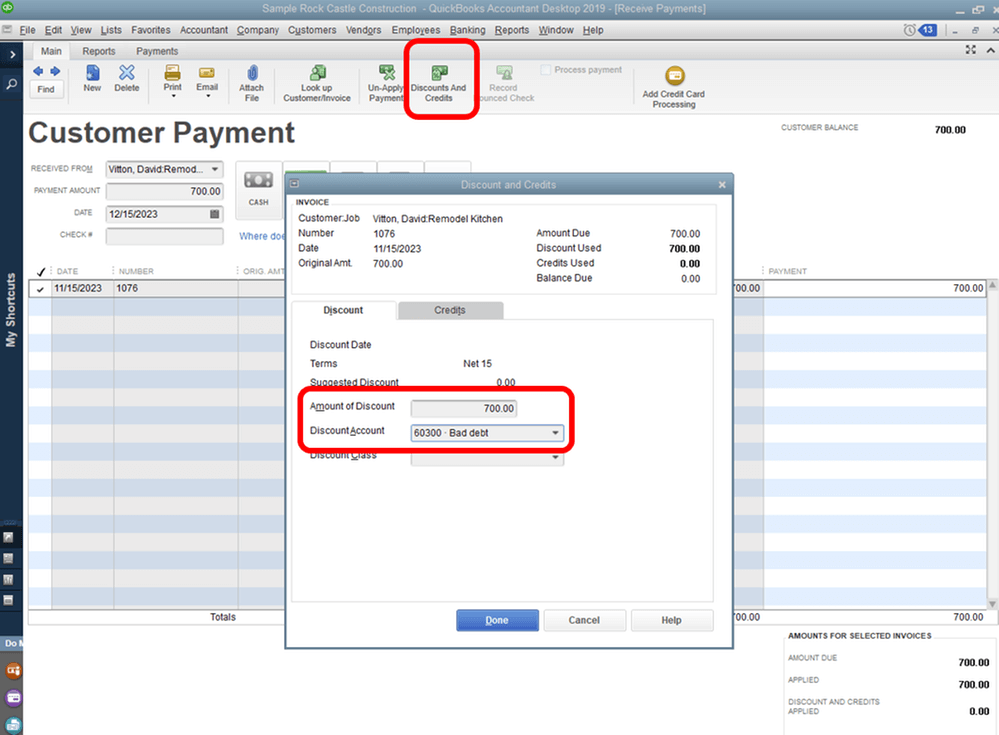

Step 2: Close the Unpaid Invoices

Follow the steps, and complete the procedure, by closing out the unpaid invoices.

- At first, visit ‘Customer‘ menu, and select the ‘Receive Payments‘ option.

- Visit the ‘Received From‘ field, enter the name of the customer.

- Enter $0.00, for the ‘Payment Amount‘.

- Choose the ‘Discounts and Credits‘ option.

- Enter the amount you’d like to write off in the ‘Amount of Discount‘ field.

- Select the discount account, choose the account, that you added in the first step.

- Click the ‘Done‘ option.

- Lastly, click on the ‘Save and Close‘ option.

Hopefully, now you have the idea that what is write-off, and how to write off bad debt in QuickBooks Online and Desktop. Still, if you have any doubts regarding this topic then you can talk to the certified QuickBooks ProAdviors through the toll-free number +1-844-405-0904 for further support.