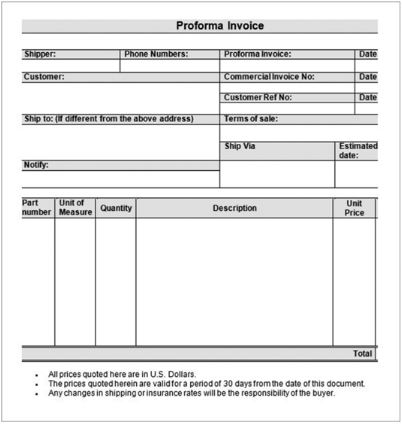

A proforma invoice is a preliminary bill of sale sent to customers in advance of delivery of assets. It is completely different from the standard invoice. In this article, we are going to take a closer look at the proforma invoice, and the way to use the proforma invoice in QuickBooks. If you are a QuickBooks user and want to create and enter the invoice then read the complete article to get a complete overview of the Proforma invoice.

What is Proforma Invoice?

Proforma Invoice is a simple document that offers a depth of knowledge of a product and services with complete details of payment information. It is also known as the estimates or Quotes and its primary function. It acts like a Preliminary bill.

It is a physical act that shows that the seller has the intent to deliver the product and service to the customer or not.

Proforma Invoice looks like a Preliminary bill. But it is not a real bill. It has been sent to the customer just before the deal has been finalized.

Types of Proforma Invoice

As we have discussed above, there are many types of Proforma Invoices. So we are discussing some of the most commonly used ones.

For Customers

It makes it easy for the both customer and the seller to have monetary disputes between them. It provides proof that the seller is going to deliver the documents to the customer.

For Shipping

It works as a substitute for businesses. It informs that the invoice is completed, so you do not need to share the information regarding the Taxes and the VAT. it determines that the product or services are going to be shipped internationally.

Other Recommended Articles:

What is the Use of QuickBooks Closing Entry

QuickBooks Web Connector: The Way to Install & Download

QuickBooks Payroll Tax Tables Updates 2018

Important Factors to Keep in Mind Before Creating a Proforma Invoice

- It is not a real invoice for the account payable for the customer. It means that the customer should not make any payment for the product or services.

- The customer should not record it as a receivable by the seller. Because it is not registered as a real invoice.

- It has not been recorded as payable and payroll by the customer until the payment has not been expected.

To Create a Proforma Invoice using QuickBooks

Here are some of the steps mentioned below to create a Proforma Invoice in QuickBooks.

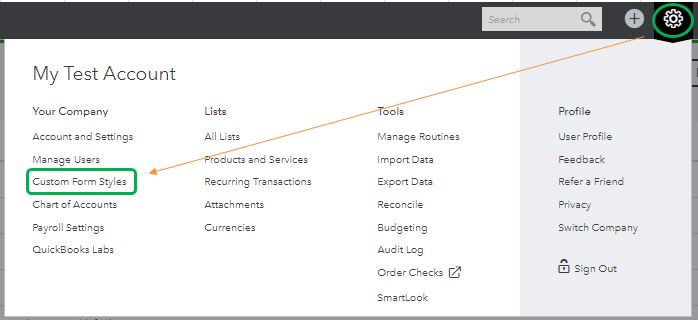

Step 1: First of all, you have to click on the gear icon. It is on the top right corner of the screen.

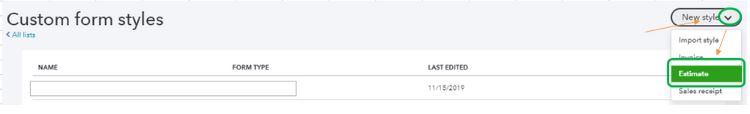

Step2: After that, you have to click on the Customs form style and then click New style.

Step 3: From the drop-down of the New style menu, select the Estimate option and after that click on the Content Tab.

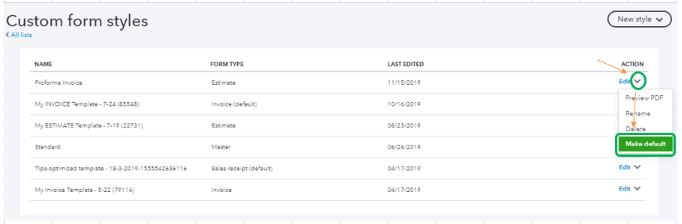

Step 4:Now drop-down from the edit menu and then click on the Make Default option.

Step 5:After that, you can change the name of the estimate according to your need. Once it is completed, then click on the save and exit option.

Step 6: Now you have all set to create a Proforma Invoice.

How you Can Create a Multiple Proforma Invoices

To create a Multiple Proforma Invoice you have to follow the below-mentioned steps

- First of all, you have to select the create icon, and after that click on the Multiple Invoice.

- Go to the Add button, which is on the left side, that will create a New Invoice.

- Add Multiple invoices, and each of the Rows has a number.

- And select any field to enter the information.

- Now by chance, you want to delete the invoice. Then you have to go to the Menu option and then select Delete Invoice.

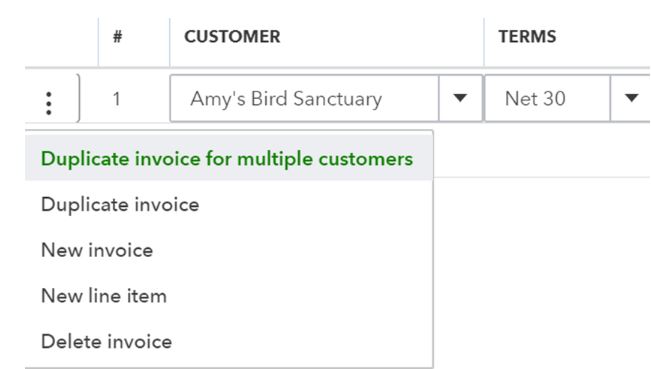

Duplicacy of an Invoice

Sometimes when the user needs to send the invoices to multiple customers. At that time the user needs to make duplicate invoices.

- While using a Duplicate Invoice for Multiple Customers.

- After that, the user selects the customers to whom he/she wants to send the invoice.

- Now you have to click on the Next. so that the invoices of each customer should be visible in Multiple Invoice Windows.

- At last, you have to save the invoice, after completing the Adding and Editing invoices.

To Add Company Logo in Proforma Invoice

The logo is added to the invoice so that the user can recognize the brand of the company.

- First of all, you have to select the invoice

- Now you have to create an invoice or you can edit the existing invoice

- Move to the Edit work info

- At last, you have to upload the file and save it.

To Apply Payment to the Correct Invoice

Follow the procedure, if you want to apply the payment to the correct invoice;

- First, you have to create an icon and then receive payment

- Now the user has to select the name of the customer

- After that, you have to verify the journal entry and then you have to check the open balance amount.

- At last, you have to save and close it.

How you can fix the payment if applied to a wrong customer

If the payment has been applied to the wrong customer. So he/she needs to correct the payment. For that, the user has to create a journal entry or the user needs to apply the payment to the correct invoice.

Steps mentioned below to correct the payment

- First of all, the user needs to go to the create icon, and then he/she used select the journal entry under other

- Now the user needs to complete the following

- Account: Receivable account

- Credits: Payment that has to be transferred

- Name of the customer in which you have to transfer the payment

- In the second line, the user needs to do the same as mentioned in the above line, except the name

- At last, you have to save and then close it.

Conclusion

In the above article, we have discussed the Proforma Invoices and the way to create, and enter in QuickBooks. We hope, you find it helpful. But in case you need any help you can contact our QuickBooks ProAdvisor expert. They will help you and give you the best solution regarding your concern.