When the user creates an account in QuickBooks and selects the day and starts to track the transaction, after that the user enters the balance of the real-life account. That amount is known as the opening balance. An opening balance is the starting balance of your account, which is used to summarise all your past transactions.

Some of the important things to be remembered

- The date you enter in the QuickBooks indicates when you have started tracking your transactions in the QuickBooks and when you have started your company.

- When you have started keeping records of an opening balance in the balance sheet created by QuickBooks. The amount you enter in the QuickBooks has been recorded in the opening balance equity, when you start entering the opening balance sheet, it means that QuickBooks is already having a correct balance sheet of your company, before entering the assets, and the liability.

Other Recommended Articles:

Resolve QuickBooks Event Log Error 4 wpr Calling Abort Issue

Resolve Run Time Application QuickBooks Error QBW32.exe

Recover QuickBooks Online Account, When you Can’t Login

How you can enter or edit opening balance in the QuickBooks

There are some steps to be followed while entering an opening balance

- First of all, you have to sign in to your bank website or you can get the bank statements.

- After that, you can go to the company menu and select the chart of accounts.

- Then you have to right-click on the charts of accounts and then select New.

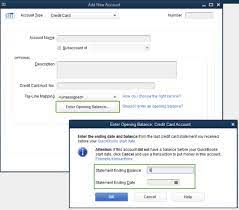

- After that, you have to select a bank account or credit card for the account type and then click continue.

- Then you have to give the name to your account name, if you have multiple accounts of the same type then give them a unique name.

- Then you have to fill the rest of the data field.

- After that, you have to select the enter opening balance. In case you want to edit your opening balance then the button will be changed.

What you have entered as the opening balance, depends on how you want to handle your past transaction.

If you don’t want to enter the older transaction

You have to enter the ending balance and ending date from your recent bank account and then press ok. Now you can start tracking your new transaction.

If you want to enter the older transaction

First of all, you have to decide how much back you want to go. After that select the date of your older transaction where you have to track the transaction of the QuickBooks. The opening balance will summarise everything before the date you have picked up. After that, you have to enter the date you have picked in the ending date field. Then you have to enter the balance of your real-life account for that date, now select ok.

- Now you have to select the save and close the record of the opening balance.

How to edit an incorrect opening balance

If you have entered any wrong information in the opening balance, you can edit it with the account history.

Steps to be followed to edit an incorrect opening balance.

- First of all, you have to go to the setting and then select the chart of accounts.

- After that, you have to locate the accounts, and then goto the action column, and select account history.

- Then you have to find the opening balance entry.

- After that, you have to select the opening balance entry.

- Then you can edit the amount. If it gets difficult for you to edit the amount on the screen, then in some cases you can edit by clicking on the edit icon.

- After that, you have to select save.

How to enter the starting balance for credit card and loan account

Here are some of the steps for entering the starting balance for a credit card and loan account.

- First of all, you have to go to the transaction page.

- Then you have to click add expense.

- Now you have to enter the starting balance on the description column.

- Now you have to enter the starting balance date in the date column.

- Now you have to go to the account column and select the account for which you are setting a starting balance.

- Now you have to enter the starting balance amount on the amount column.

- Now you have to choose the withdrawal from the next drop-down.

- Now select the owner’s equity in the category column.

- Now save the new transaction.

How to create a journal entry for the opening balance

Income and Expense of your account

To check the income and expense of your account you don’t want to enter the opening balance. These accounts automatically track your earning and spending.

Vendors account payable and account receivable

If there is any outstanding balance before your opening balance date, you just have to enter the individual bills, it will create an open balance that collectively results in your Accounts payable and accounts receivable.

Some of the information or documents which you need for the Accounts payable and accounts receivable are

Sales receipts, invoices, customer returns, customer payments, deposits, sales tax payments, vendor bills, vendor credits, and bill payments.

How to check the opening balance entry

To check the opening balance entry you have to follow some steps

- First, you have to go to the list-menu and select the chart of accounts.

- Now you can search the opening balance equity and open it.

- Now you have to check the account balance, it should be 0.00.

If you find that the account balance is not 0.00 then you don’t have to worry, you just need to write down the remaining balance and then run the balance sheet report of the last year.

- First, you have to go to the reports.

- Then select the balanced sheet standards from the dates drop-down and select the last fiscal year.

- After that, you have to check the retained earning balance.

- At last, you have to compare the retained earning balance with the remaining balance of the opening balance equity account.

Summary

I hope the above article is helpful for you, in this article we have discussed some of the steps which you have to keep in mind when you want to add, enter or edit opening balance in QuickBooks and in case if you get any problems regarding the above article you can contact to our QuickBooksProAdvisor Experts. They will help you and give you the best solution regarding your concern.